Geothermal Tax Credits & Incentives

Another reason to go Geo.

Energy Efficiency Upgrades

Tax Credit & Incentives

In August 2022, the credit for geothermal heat pump installations was extended through 2034. Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is eligible for the credit. The credit has no limit and there's no limitation on the number of times the credit can be claimed.

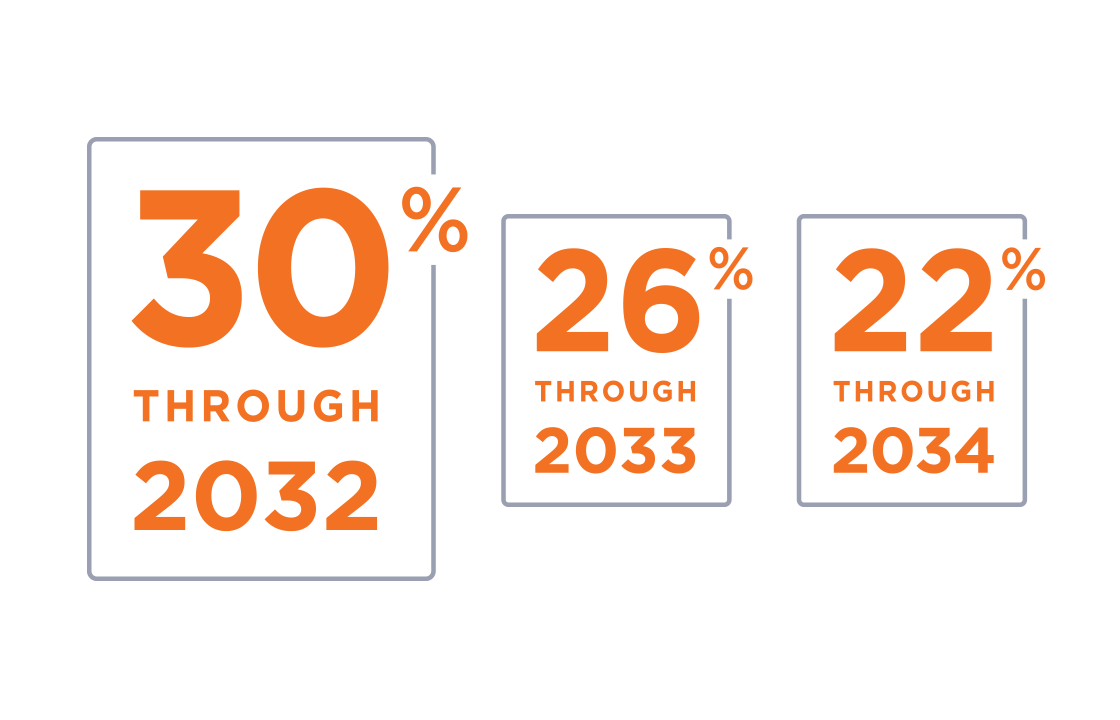

US Tax Credits Through 2034

The energy credit can be combined with solar and wind credits as well as energy upgrade credits. A 30% federal credit for residential ground source heat pump installations has been extended through December 31, 2032. Energy efficiency income tax deduction will be lowered to 26% for systems that are installed in 2033 and 22% in 2034, so act quickly to save the most on your installation. Save money with renewable energy.

Check For More Local Incentives

In addition to the federal tax credit, some Idaho Power, state, local, and utility incentives may be available in your area for even more savings on installing a efficiency geothermal heat pump.

Idaho Power Heat Pump Click Here.

Idaho Power Water Source Heat Pump Click Here.

Check out the Database of State Incentives for Renewables & Efficiency (DSIRE) website to find policies and incentives in your area.

© 2024 Idaho Geothermal, LLC